Diminishing value depreciation rate

2000 - 500 x 30 percent 450. You can use this tool to.

Depreciation Highbrow

Example of Diminishing Balance Method of Depreciation.

. Prime cost straight line method. Depreciation is applied at a fixed proportion to the book value of the asset according to the. The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16.

ATO Depreciation Rates 2021 Table A. The rate of depreciation is applied to the diminishing value of the asset. Computers effective life of 4 years.

The depreciation rate applies to the diminished value of the asset after it has been depreciated each year. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. And the residual value is.

Depreciation rate finder and calculator. The recoverable cost is 4000 and you are using a 20 flat-rate. The current Effective Life estimates for computers under Table B are.

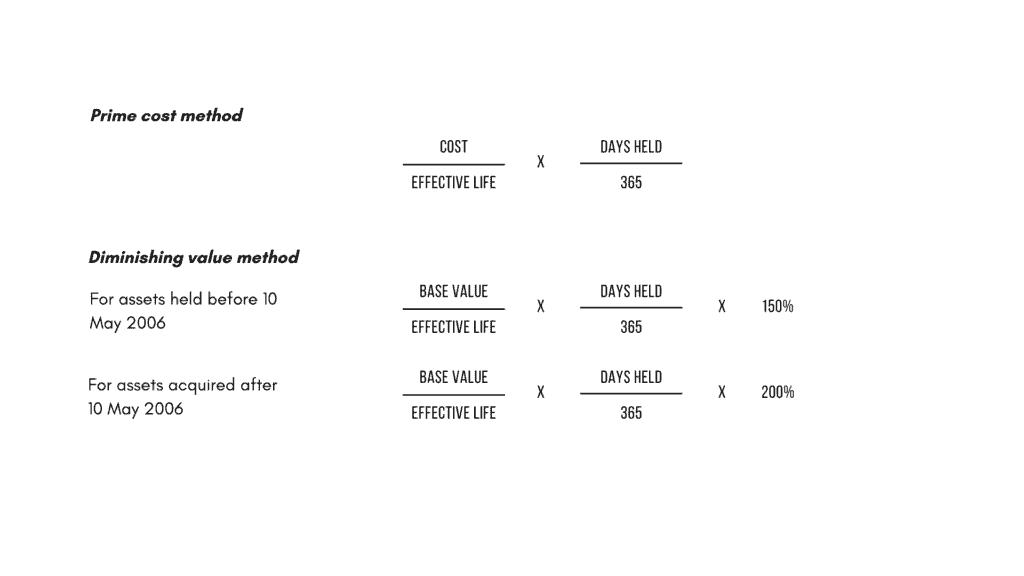

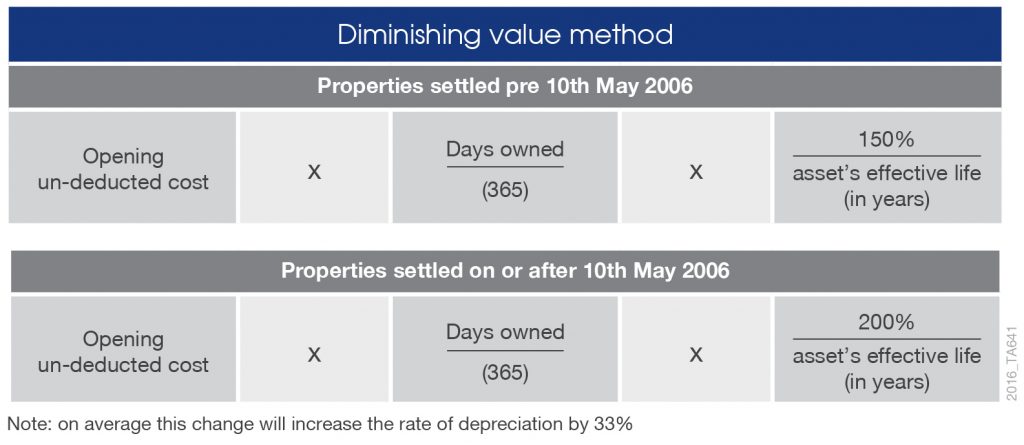

Assets cost x days held. Calculate depreciation for a business asset using either the diminishing value. This kind of depreciation method is said to be highly charged in the first.

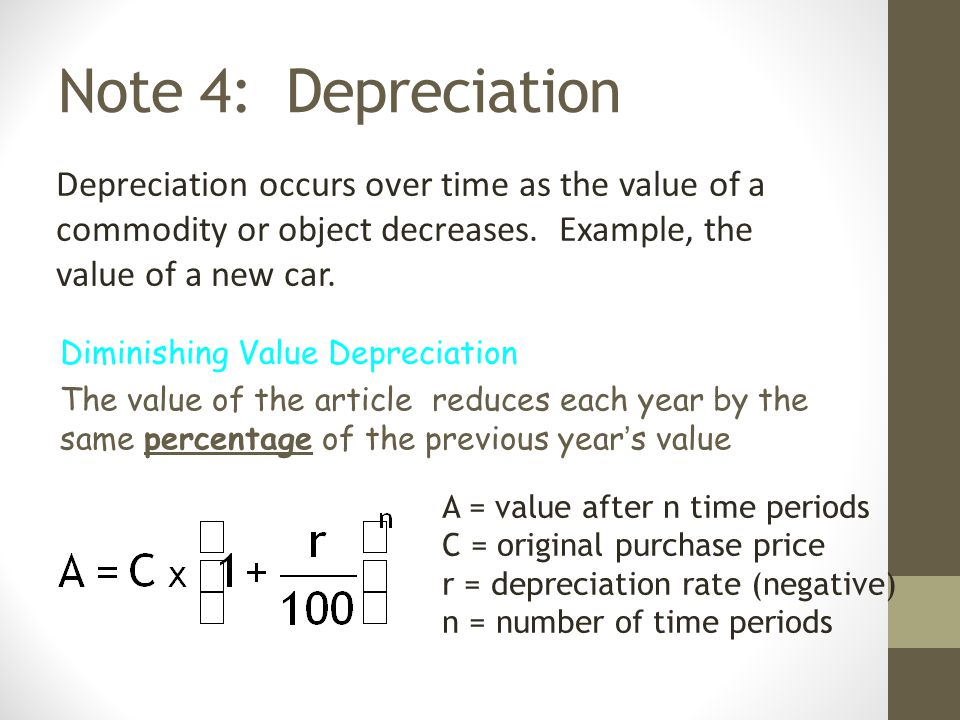

This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula. Depreciation amount book value rate of depreciation100. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method.

Find the depreciation rate for a business asset. Name Effective Life. Up to 8 cash back Enter an effective life of 8 years the rate is 125 and the annual depreciation is 16250 100 8 125 1300 x 125 16250 Diminishing value.

Under the depreciation formula this converts to a Diminishing Value. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. Carpet has a 10-year effective life and you could calculate the diminishing value.

What OOB depreciation method can be used for the diminishing-value method straight-line rate multiplied by 200 for. Depreciation of most cars based on ATO estimates of useful life is. Diminishing Value Rate Prime Cost Rate Date of Application.

Diminishing value - depreciation. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. On 01042017 Machinery purchased for Rs 1100000- and paid for transportation charge 150000- to install.

If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. The depreciation rate is 20 and the depreciation amount is 16000 in each of the five years. 264 hours 52 cents 13728.

Rate Adjustments - Diminishing Value Depreciation Method Example. Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims. Cost value diminishing value rate amount of.

You place an asset in service in Year 1 Quarter 1. Diminishing Balance Method Example. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

As you can see the prime cost depreciation method affords a fixed rate of depreciation. In contrast the diminishing value method has a more significant upfront. Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation.

Cost value 10000 DV rate 30 3000. Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now. Take for example a 10000 asset with a useful life of 10 years.

Depreciation formula diminishing value Friday September 9 2022 Edit.

Depreciation Of Vehicles Atotaxrates Info

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Diminishing Value Method Youtube

Written Down Value Method Of Depreciation Calculation

Double Declining Balance Depreciation Calculator

Working From Home During Covid 19 Tax Deductions Guided Investor

Diminishing Value Vs The Prime Cost Method By Mortgage House

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Formula Calculate Depreciation Expense

Tax Depreciation Schedule Methods Capital Claims

Written Down Value Method Of Depreciation Calculation

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Rate Calculator Store Save 45 Countylinewild Com

Ato Tax Depreciation Methods Mcg Quantity Surveyors

Note 4 Depreciation Depreciation Occurs Over Time As The Value Of A Commodity Or Object Decreases Example The Value Of A New Car Diminishing Value Ppt Video Online Download

Pick The Method To Suit Your Investment Strategy Mygc Com Au

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting